An easy IRA may also be very best fitted to companies who usually do not already manage or lead to a different employer-sponsored retirement prepare in the exact same yr.

The plan is funded with contributions deducted from staff members' salaries, and annual employer contributions. Each individual qualified staff can come to a decision whether or not to take part and simply how much to contribute, but once-a-year employer contributions are mandatory with number of exceptions. For more info, see the answer to "What do I should learn about contributions?".

If the number of men and women you use exceeds a hundred, you are able to still keep your SIMPLE IRA prepare for two many years after the 1st 12 months the a hundred-worker limit is exceeded.

Sixty days before every year, employers need to comprehensive the Summary Description and supply this recognize to staff members listing the sort of employer contribution which will be created to the impending year.

You've got the choice to open up your account on-line or by mailing within an application When your employer has:

Though, companies may possibly decide to match only Individuals personnel who lead or could supply a contribution to all qualified staff. Annually, companies may perhaps switch among match OR lead for all, if ideal.

Your personnel have the choice to open up their accounts on line or by mailing in an application. Download, print, and distribute the next documents to each suitable staff who wishes to use by mail.

Larger sized employer contributions are needed if the upper Restrict was communicated in time. Businesses ought to make both a 4% dollar for greenback match, or maybe a three% non-elective contribution.

Or, immediate them into the "Begin – Workforce" portion underneath, which is able to supply Instructions to enroll on the web.

Basic IRA plans are most effective fitted to corporations that employ 100 people today or fewer, Each individual of whom acquired a minimum of $five,000 in the course of the prior calendar year. This involves all workers, irrespective of whether or not They can be eligible to get involved in your Basic IRA plan.

In almost YOURURL.com any two out of 5 consecutive yrs, chances are you'll match a smaller sized proportion, not below one%. You simply add for the retirement accounts with the eligible staff members who make salary deferral contributions.

This data provided by Charles Schwab Corporation Here's for general informational reasons only, and isn't intended to become a substitute for unique individualized tax, legal, or investment planning tips.

one. You could established a lessen minimal compensation total if you want to enable additional workforce to participate.

Companies will need to finish and provide a replica of a SIMPLE Summary Description to each eligible worker annually. Workforce need to obtain the completed Summary Description at the least sixty days prior to Every single new calendar year starts.

Hold the finished initial in your documents and supply a replica to every suitable personnel. You might make this happen on a yearly basis all through Open up Enrollment.

Pre-tax deferrals: Staff income deferral contributions are created in advance of federal profits tax is deducted.

A method to lead to your very own retirement simply and often, and support your personnel contribute to theirs

Employer contributions has to be produced yearly by the employer's tax submitting deadline, which include extensions. Personnel contributions are deducted from staff' salaries and should be deposited at least every month.

If you favor to open your new account by paper application, down load the paperwork underneath, fill them out, and return them for your employer. For concerns or support completing the SIMPLE IRA types, Make contact with your employer or System Administrator.

Companies will need to have supplied prior see of the upper limitations to all staff no less than 60 times ahead of the conclude of 2024. Greater employer contributions will also be needed if the higher limit might be allowed and was communicated in time.

With the matching alternative, you match the employee contribution dollar for greenback around three%, not to exceed the income deferral Restrict for that year.

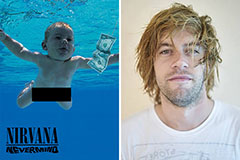

Spencer Elden Then & Now!

Spencer Elden Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!